Startups face enough challenges without the added stress of complex regulations. Yet, navigating compliance requirements from the beginning can mean the difference between a trusted brand and a fragile one. Compliance isn’t just a box to check off; for startups, it’s a cornerstone of stability, security, and long-term growth.

Let’s delve into why regulatory compliance is a crucial investment that smart startups make to protect their future.

Intro: Compliance for Startups

From our experience working in compliance, we’ve seen how early-stage businesses benefit from prioritizing compliance—not only to avoid legal troubles but to foster trust, mitigate risks, and position themselves for success.

1. Legal Security and Risk Mitigation: The Foundation of Compliance

Startups face a high-risk environment where regulations can seem like a moving target. However, establishing compliance from the start is a straightforward way to reduce legal exposure and focus on growth. In industries like fintech, healthcare, or tech, failing to comply with standards like GDPR or HIPAA can lead to legal troubles that a young company simply can’t afford.

By prioritizing compliance, startups:

- Avoid costly fines and legal issues that could otherwise derail progress.

- Protect sensitive data from mishandling or breaches.

- Demonstrate a commitment to lawful practices, building credibility with users, investors, and partners.

We’ve often seen that early compliance efforts allow startups to move forward with confidence, knowing that they’re prepared for potential audits and regulatory changes.

2. Building Customer Trust and Credibility

With over 20 years in business, we know that trust is one of the hardest things for a new company to earn and one of the easiest to lose. Compliance plays a major role here. Today’s customers care deeply about their data privacy and security, and they are more likely to choose companies that take these concerns seriously. When startups demonstrate commitment to compliance, they’re also showing customers, partners, and investors that they are reliable.

Early-stage startups that prioritize compliance:

- Build stronger customer loyalty, as people feel safe sharing their information.

- Stand out in competitive markets by signaling a serious approach to data security.

- Increase appeal to investors who view compliance as a marker of long-term stability and ethical responsibility.

Building customer trust isn’t just a one-time event; it’s a continuous effort. Startups that align with compliance standards make it clear that they’re here for the long haul, not just quick gains.

3. Facilitating Market Access and International Growth

Compliance isn’t just about meeting regulations; it’s also a gateway to new opportunities. For many startups, growth involves entering regulated markets or expanding internationally. Meeting standards like SOC 2, ISO 27001, and FedRAMP makes a company more appealing to enterprise clients and simplifies entry into new regions. These standards aren’t just hoops to jump through—they’re benchmarks that prove a startup’s readiness for larger, more complex environments.

Compliance can help startups:

- Enter new markets smoothly by meeting local or industry-specific requirements.

- Build partnerships with established players who require vendors to meet rigorous security and privacy standards.

- Lay a scalable foundation for adapting to changing regulatory landscapes as they grow.

For startups aiming for international expansion or large clients, meeting compliance standards isn’t optional—it’s essential.

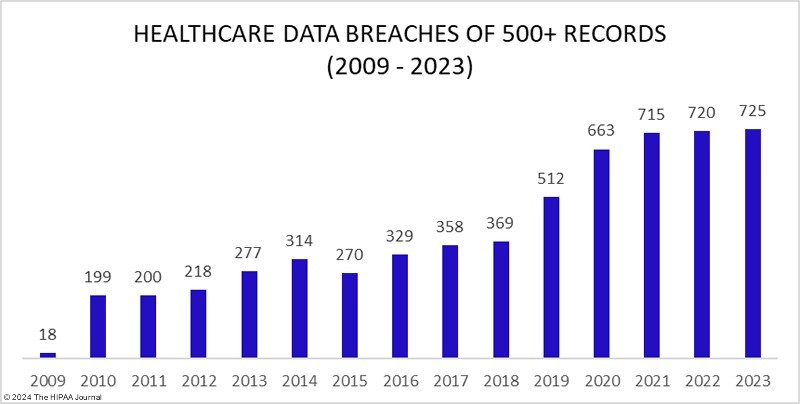

4. Enhancing Data Security and Privacy Practices

In a world where data breaches make daily headlines, startups simply can’t afford to ignore data security. Compliance frameworks like the NIST Cybersecurity Framework (CSF) and CIS Controls provide a playbook for managing and protecting data. By following these frameworks, startups establish processes that not only protect data but also build resilience against cyber threats.

Key benefits of strong data security practices through compliance include:

- Reducing the likelihood of data breaches that can lead to reputational and financial damage.

- Creating a structured approach to security, which can be adapted and scaled as the company grows.

- Reassuring stakeholders that their information is safe, fostering trust.

As someone who has seen startups recover from data breaches, we know firsthand that the effort spent on compliance from the start is well worth it. It’s always easier to build secure processes early than to repair a damaged reputation later.

5. Streamlining Operations and Cutting Costs

Some founders worry that compliance is too costly or resource-intensive for a small team. In reality, compliance often brings unexpected efficiency and cost savings. Automated compliance tools help startups streamline their operations, reduce errors, and make audit preparations much smoother. Rather than being an added cost, compliance can reduce resource drain and free up time to focus on growth.

Here’s how compliance creates efficiency:

- Automates repetitive tasks, reducing the need for manual data entry and tracking.

- Saves time and resources by reducing the likelihood of regulatory fines and penalties.

- Allows for predictable operations, as compliance frameworks provide structured workflows.

We know startups where early compliance investments translated into long-term savings by preventing the reactive, “quick-fix” approach that often becomes necessary without these structures in place.

6. Demonstrating Ethical Practices and Social Responsibility

At the core of compliance is a commitment to doing things right, and that’s something every startup should aim for. Compliance isn’t just about following the law; it’s about setting ethical standards that resonate with today’s customers and employees. Startups that integrate compliance as part of their core values create a culture of accountability and responsibility that lasts.

A culture of compliance leads to:

- Stronger internal morale, as employees take pride in working for a responsible organization.

- A trustworthy brand image, which resonates with socially conscious customers.

- Better stakeholder relationships, as transparency and ethical practices, attract investors and partners.

In our experience, startups that embrace compliance as a part of their culture see long-term benefits in loyalty and reputation that go far beyond regulatory requirements.

Ready to Simplify Compliance for Your Startup?

At Namtek Consulting Services, we understand the unique challenges startups face when it comes to navigating compliance. Our team of experts is here to guide you through every step of the process, ensuring that your business remains secure, trusted, and compliant from day one. Whether you’re looking for a fully managed compliance solution or a more DIY approach, we have the right solution tailored to your needs.

We offer a free consultation to help you assess your current compliance requirements and find the best approach for your business. Let us handle the complexity, so you can focus on growing your company with confidence.

Contact us today to learn more about how our compliance services can support your startup’s success!